Microfinance During the COVID-19 Pandemic: Transitioning to an Online Model in Nicaragua

2 julio, 2021

Blog, Stories

The COVID-19 pandemic has created countless challenges for women in Nicaragua, as many have lost their jobs or found themselves forced to close their bus inesses. At the same time, Pro Mujer has also struggled to continue to provide financial, capacity building, and healthcare services to our clients while protecting both our benefiacieries’ and our staff’s health and wellbeing.

inesses. At the same time, Pro Mujer has also struggled to continue to provide financial, capacity building, and healthcare services to our clients while protecting both our benefiacieries’ and our staff’s health and wellbeing.

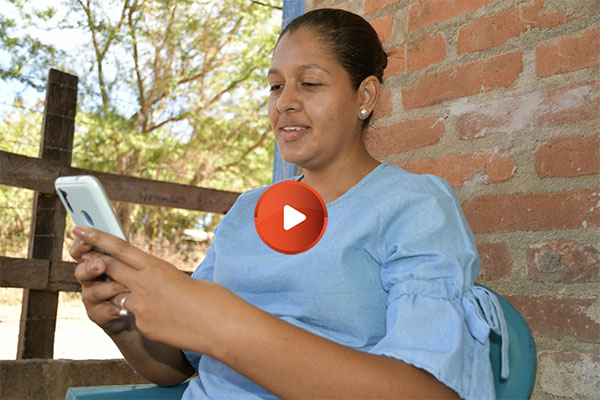

To address this issue, we accelerated the digital transformation of many of our services. Although the pandemic made it impossible to continue with our traditional model of in-person and one-on-one support, the Pro Mujer team in Nicaragua transitioned to an online model that allowed Pro Mujer financial advisors to support women using only their cell phones.

Using digital tools, Pro Mujer has continued to expand access to financial services for women who are unable to access the capital they need to sustain and grow their businesses.

For example, members of Pro Mujer’s communal banks are now able to receive information about preventive healthcare and online entrepreneurship training, including information about how they can shift their businesses online and new business opportunities and ways to commercialize their products.

Getting used to these new digital tools has been a challenge, but client leaders like Valeska Coca, who received an initial loan to help support her handicrafts workshop, have helped support other women in their communities adjust and adapt to this new reality.

Pro Mujer also launched a digital wallet service that allows users to complete transactions and access loans straight from their mobile device, bypassing the traditional channels and physical branches.

These new technologies have had a big impact on the lives of women like Valeska. “I think it’s important to take advantage of technology,” she said. “It can help us learn more quickly and easily and help us build our confidence.”