Using Financial Inclusion to Expand Access to Education in Latin America

23 agosto, 2021

Blog

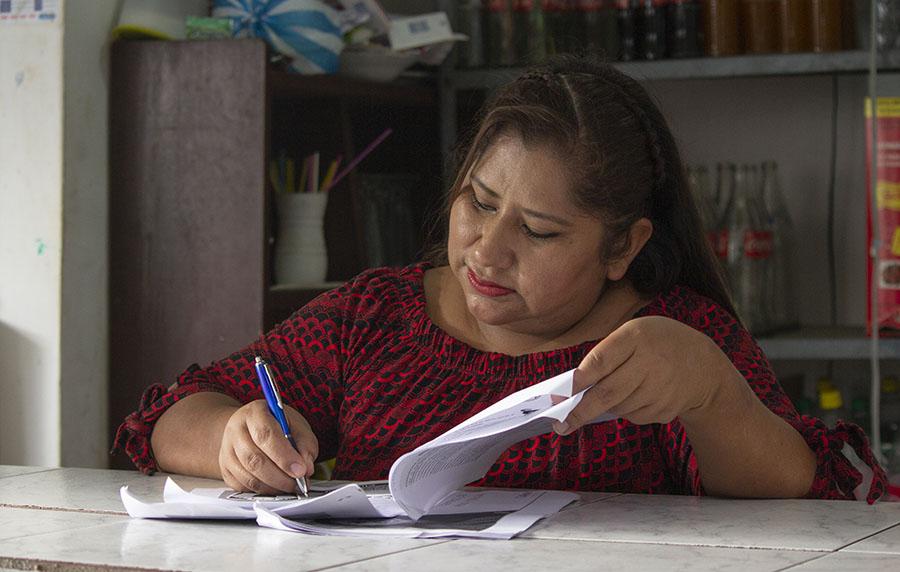

In Bolivia, Pro Mujer has expanded its financial services portfolio to offer more women access to higher education.

Pro Mujer Bolivia recently launched a new product to increase the accessibility of higher education in Bolivia and help women accomplish their dreams. Through a personal loan and support from a network of employers, women in Bolivia will have the opportunity to improve their professional skills and join the job market once they have graduated from college.

Pro Mujer Bolivia recently launched a new product to increase the accessibility of higher education in Bolivia and help women accomplish their dreams. Through a personal loan and support from a network of employers, women in Bolivia will have the opportunity to improve their professional skills and join the job market once they have graduated from college.

Higher education is one of the most impactful ways to improve socioeconomic growth and development in Latin America. According to the United Nations Educational, Scientific and Cultural Organization (UNESCO), people with a university degree are more likely to live longer thanks to more development opportunities, economic stability, and healthier lives, and are also more likely to be leaders in their communities, among other benefits.

However, many communities, including women with lower incomes, often face significant barriers to accessing higher education and completing their degrees. According to UNESCO, only 10 percent of the population in the lowest income brackets were able to access higher education compared to 77 percent in the highest ones.

In addition to covering tuition costs, the personal loan provided by Pro Mujer can also be used to cover necessary educational expenses, including computers, tablets, textbooks, etc.

“We established strategic partnerships with educational institutions to provide comprehensive support for the educational needs of women in the region, which will improve their access to financing and skill-building opportunities that can better their quality of life,” said Dayler Mijail Gonzales, Deputy Manager of Individual Loans at Pro Mujer Bolivia.

As part of this initiative, Pro Mujer’s social innovation team, which drives initiatives to advance financial inclusion in Bolivia, led research on the financial needs of Pro Mujer clients and their families in regards to accessing higher education. The data shows that approximately 62 percent are interested in an education loan. Of these, about 37 percent planned to use the loan to pay for their own education, while about 52 percent planned to use the loan to pay for their children’s education. Furthermore, the data found that 36 percent of respondents were interested in using the loan to cover an educational program that lasts more than three years and 32 percent require a loan totaling more than 7,000 Bolivian bolivianos. The results of this study helped Pro Mujer adjust the new product to effectively meet client’s financial needs and support education of women throughout Bolivia.

Expanding the financial services that Pro Mujer offers in Bolivia will allow us to support another area of our clients’ lives—their education and that of their children—and represents another step towards our mission of empowering women so that they are able to reach their full potential.