Top Five Takeaways from the GLI Forum LATAM 2021

19 noviembre, 2021

Blog

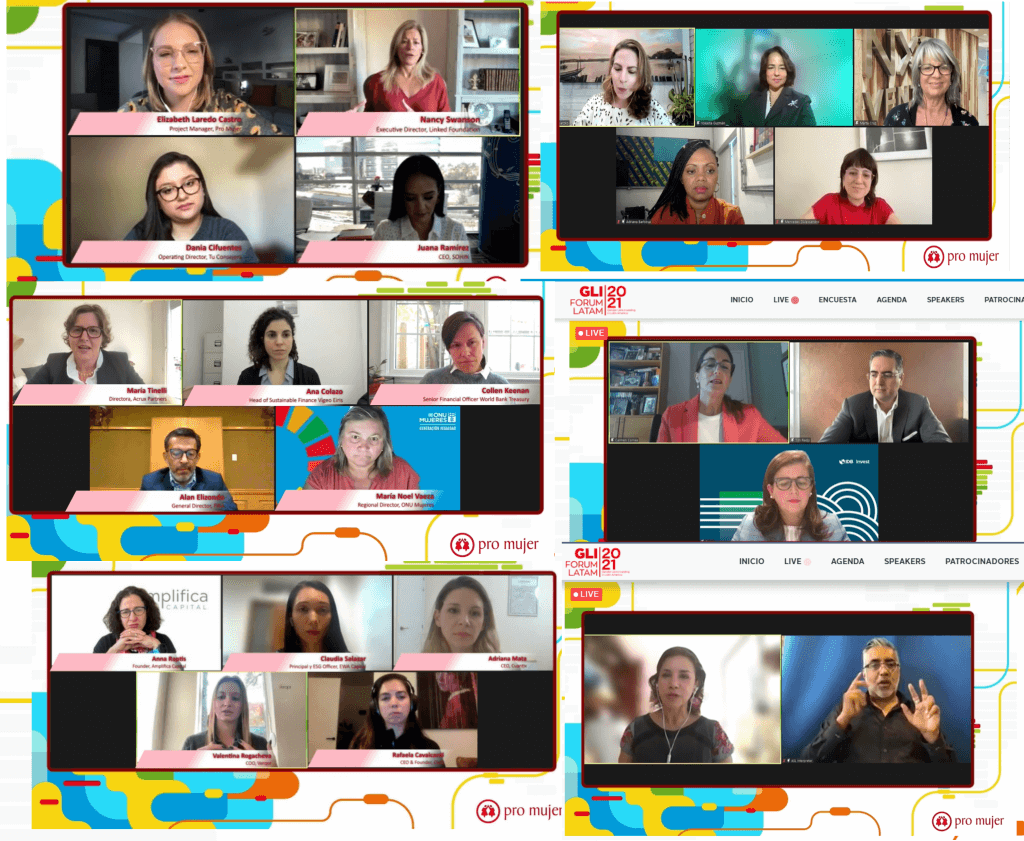

From November 9-11, more than 2,000 of people joined Pro Mujer’s second annual Gender Lens Investing Forum (GLI) Forum LATAM to discuss how gender lens investing can catalyze gender equality and create more inclusive economies in Latin America. Throughout the event, entrepreneurs, investors and other industry leaders participated in workshops and panels to generate solutions for social challenges, rethink the financial system and find opportunities for collaboration to advance gender lens investing in Latin America.

“Investing with a gender perspective has the potential to contribute to gender equality while strengthening the region’s economy, boosting women’s leadership and creating inclusive and sustainable opportunities for all,” said Carmen Correa, Vice President and Chief Operating Officer at Pro Mujer during the opening of the event.

Here are the top Five takeaways from the event:

1. Unconscious bias is one of the biggest challenges facing women entrepreneurs, and we must incorporate intersectionality into investment decisions as part of the solution.

“Unconscious bias is real. While we are on a mission to be as inclusive and diverse as possible, we find that one of the biggest challenges is overcoming implicit bias,” said Marcella Ceva, Chief Investment Officer of WE Ventures, during the first session of the GLI Forum LATAM 2021, GLI 101.

The biggest challenges that women entrepreneurs face is that the system is often biased against them, with just 6% of all capital going to female-led businesses in Latin America. As Adriana Mata, CEO of Cuantix, shared in a conversation between entrepreneurs and investors on raising capital, “Investors will not tell you that they will not in invest in you because you are a woman, but the implicit bias is there, and we have to keep working to overcome this barrier.”

“Raising awareness about inclusion and diversity has an impact on the economy, and so if we truly want to generate sustainable ventures, we need to base them in human diversity,” said Pamela Molina, Executive Director for the World Federation of Deaf People, at a session on changing systems through entrepreneurship at the GLI Forum LATAM 2021.

It is important to use an intersectional lens when making investments, meaning that it is important to consider how someone’s overlapping identities and experiences affect the prejudices they face. In including diverse voices and diverse points of view, barriers and challenges can become more visible and investors and entrepreneurs can work together to solve them. As Alexa Blain, Managing Partner for Deetken Impact, shared during the GLI 101 session, “When investors are representative of the communities that they are investing in, we can really drive change.”

2. Handing money to women entrepreneurs is not enough, it is also important to build their capacity.

“One of our biggest learnings is that, in addition to capital investment, we need to provide technical assistance to women entrepreneurs,” said Evelyne Dioh, Managing Director of WIC Capital during a GLI Forum LATAM 2021 case study analysis session.

While it is very important to provide capital to the 70% of women entrepreneurs in the region who do not have the money to start and run their businesses, it is equally as important to give women access to the resources and tools that they need to build skills. As such, during this year’s forum, Pro Mujer, in partnership with the Visa Foundation, launched Emprende Pro Mujer, a new digital platform to boost the economic autonomy of women entrepreneurs in the region by providing tailored tools and resources that offer mentoring and training. As Payal Pathak, Program Officer for the Visa Foundation, shared during the launch session, “We applaud Pro Mujer for meeting women’s needs and there are already an incredible number of key learnings from women who have used Emprende that we are working to integrate to meet women’s evolving needs.”

3. Increasing the number of women investors can help get more money into the hands of women.

“A huge challenge that I see for women entrepreneurs is the lack of women investors in the field and the fact that 90% of people making investment decisions are men, which really has an impact on which entrepreneurs receive financing,” said Anna Raptis, Founder of Amplifica Capital, during a conversation between investors and entrepreneurs on raising capital at the GLI Forum LATAM 2021.

Women-led funds are a young industry in Latin America and that supporting first-time female fund managers can help grow a more inclusive economy. As Marcella Ceva, Chief Investment Officer for WE Ventures said during the GLI 101 session, “Our biggest learning so far is that we need support women in all industries to help them reach the top – it is important to bring capital to women entrepreneurs, but it is also just as important to have more women investors.”

4. Alternative funding models like gender bonds can become a catalyst for gender equity.

“We have to keep creating products so that we can provide gender lens investing opportunities to a much wider spectrum of investors,” said Gema Sacristan, Chief Investment Officer for IDB Invest, during a panel on the failures of the financial system for women entrepreneurs during the GLI Forum LATAM 2021.

There are various initiatives to create innovative financial mechanisms that can reach more women entrepreneurs, especially those in the “missing middle,” meaning they are too big to qualify for microfinance loans and too small or risky for other, more traditional financing, such as business banking, venture capital or private equity. One of these funding mechanisms is a gender bond, which is a financial vehicle used to reduce gender inequality by improving women’s access to financing, leadership positions and equality in labor markets. Thus far, 30 gender bonds have been issued worldwide and 11 of these have been in Latin America, which indicates the region “is a pioneer in investing in women-led companies,” according to Sacristan.

5. Building trust between investors and entrepreneurs is critical to gender lens investing.

“Investing in people is key. As investors, we need to understand and support entrepreneurs and trust that they will seek solutions before they run into big problems so that we can help them solve the big problems,” said Claudia Salazar, Principal and ESG Officer of EWA Capital said during a panel discussion between entrepreneurs and investors on raising capital during the GLI Forum LATAM 2021.

Having alignment between investors and entrepreneurs is key to generating financial return on investments and advancing gender equality. Both investors and entrepreneurs must do their due diligence to 1) ensure that their goals are aligned and 2) build trust, so that, if things do not go according to plan, they can work together to adjust accordingly and continue on a path toward success. As Ara Yoo, Senior Manager of the International Program for Fundación Chanel, said during a panel session on the catalytic role of philanthropic capital in gender lens investing, “It is important to understand the needs of the organizations to enable them to invest in the necessary programs that they need to succeed, which can be done through flexible funding.”

To learn more about some of the key themes from the GLI Forum 2021 LATAM, watch the on-demand recordings.